The pet industry in the United States has grown at a remarkable pace over the past decade. In 2025, this growth continues unabated, with pet treats occupying an increasingly prominent position in the marketplace. From traditional wholesale dog treats and wholesale cat treats to newer innovations like wholesale freeze dried dog treats, the pet treat segment has become a hotbed of consumer interest and industry innovation. This blog takes a deep dive into the evolving pet treat landscape in the US, highlighting the major trends, challenges, and opportunities. Whether you’re a distributor, retailer, or an e-commerce entrepreneur, understanding these dynamics can help you make informed decisions and capitalize on this thriving market.

1. Introduction

There has never been a more exciting time to be involved in the pet treats industry. Pet ownership in the United States has been on an upward trajectory for years, and the aftermath of global events in the early 2020s only intensified this trend. According to the 2024–2025 National Pet Owners Survey by the American Pet Products Association (APPA), about 70% of US households now include at least one pet. This surge in pet ownership translates into a bigger market for treats, driven by consumer demands for variety, quality, and functionality.

Yet in 2025, the pet treat market is not merely about selling snacks. It’s about addressing consumer desires for health benefits, sustainability, and tailored formulations. Retailers—both offline and online—are vying to meet these evolving demands, fueled by robust wholesale networks. From wholesale pet treats that can be quickly branded and stocked to specialized wholesale dog treats made from single-ingredient proteins, the market is saturated with choices. But what truly distinguishes leading brands and retailers is their ability to stay at the forefront of trends and adapt quickly.

In this comprehensive look at the US pet treats landscape in 2025, we’ll dissect crucial trends, highlight key opportunities, and offer insights into how you can navigate this space effectively—whether you’re an established distributor, a large retailer, or an e-commerce upstart.

2. Market Growth and Consumer Trends

2.1 Size and Forecast

The overall US pet treats market size in 2025 is projected to be over USD 7.2 billion, reflecting a steady compound annual growth rate (CAGR) of around 5–6% over the past few years, as reported by various industry analyses (e.g., Pet Food Industry). This consistent growth is driven by multiple factors:

- An increase in the pet population.

- Greater disposable incomes dedicated to pet wellbeing.

- A shift toward premiumization, where pet owners willingly pay extra for specialty treats with high-quality ingredients.

2.2 Key Consumer Behaviors

- Humanization of Pets

Pet owners treat their dogs and cats like family members. This humanization trend has led to an uptick in demand for “gourmet,” “organic,” and “functional” treats. It’s not just about feeding pets anymore—it’s about treating them to the best. - Focus on Health

There is growing concern about pet obesity, food sensitivities, and overall wellness. Consumers are reading labels carefully, seeking out treats with clean ingredients and transparent sourcing. Grain-free, single-protein, and limited-ingredient lines are particularly popular. - Value for Money

While premiumization is on the rise, many consumers still compare prices. The sweet spot is providing high-quality treats at a competitive rate. This is where wholesale pet treats shine—offering retailers and distributors an opportunity to keep profit margins healthy while satisfying consumer expectations.

- Frequent Snacking

Not only are pet owners buying higher-quality treats, but they’re also purchasing them more frequently. With the increase in pet adoption, the frequency of treat purchases has risen, indicating that consumers see treats as a regular part of their pets’ diets rather than an occasional indulgence.

3. Health & Wellness Focus

3.1 Functional Pet Treats

Functional treats address specific health concerns, such as joint support, skin and coat health, or digestive wellness. Some contain supplements like glucosamine, chondroitin, or probiotics. These specialized treats are becoming a staple in retailers’ lineups.

3.2 Nutrient-Dense Formulations

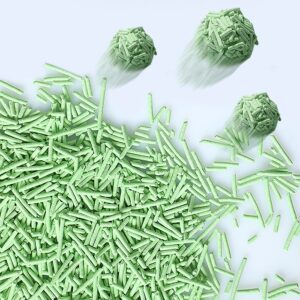

Pet owners are reading ingredient labels more closely. This has fueled innovation in the wholesale freeze dried dog treats category, known for preserving maximum nutrient content. Freeze-dried treats often have fewer additives and can be made from single-ingredient proteins like chicken, beef, or salmon, appealing to pet owners who prioritize natural nutrition.

3.3 Lifestyle Alignment

In 2025, it’s not uncommon for pet owners to follow specific diets—vegan, paleo, gluten-free—and want similar options for their pets. While not all of these diets are scientifically recommended for animals, manufacturers and retailers see a segment of consumers demanding them. That said, the majority of growth is still in protein-rich formulations that address ancestral canine or feline diets.

4. Sustainability & Ethical Sourcing

4.1 Eco-Friendly Packaging

From compostable pouches to biodegradable bags, packaging has become a key marketing point for pet treat brands. As environmentally conscious consumers look to reduce plastic waste, eco-friendly packaging can sway purchasing decisions.

4.2 Responsibly Sourced Ingredients

Beyond packaging, consumers also demand sustainably and ethically sourced ingredients. This includes:

- Humanely raised livestock for meat-based treats.

- Sustainably caught fish for fish-based treats.

- Fair-trade fruits and vegetables for plant-based formulations.

According to a 2024 Nielsen survey on pet food trends, over 60% of consumers express willingness to pay more for treats that prioritize ethical sourcing. This statistic underscores how critical it is for brands to communicate their sustainability efforts clearly.

4.3 Transparency and Traceability

Consumers increasingly expect brands to disclose supply chain information—where ingredients come from, how they are processed, and what measures are taken to ensure quality. Wholesalers that can guarantee full traceability add significant value to their retail partners.

5. Wholesale Pet Treats and Supply Chain Dynamics

5.1 The Importance of Wholesale

For many retailers—whether online or brick-and-mortar—partnering with reliable wholesalers can make or break profitability. Wholesalers act as the backbone of the industry, providing bulk wholesale dog treats, wholesale cat treats, and various niche products at competitive rates. By purchasing in volume, retailers can maintain healthy margins while ensuring consistent stock.

5.2 Key Wholesale Considerations

- Consistency in Quality

Retailers look for suppliers who maintain high and consistent quality standards. Wholesalers with transparent quality control processes, strong regulatory compliance, and robust logistics networks stand out. - Inventory Management

As consumer preferences shift quickly, having a flexible inventory is paramount. Wholesalers that offer scalable inventory solutions enable retailers to respond to changing trends without significant risk.

- Customization & Private Label

Many retailers want their own private label or at least the option to customize packaging. This adds value to the brand and can drive consumer loyalty. Finding a wholesale partner adept in OEM/ODM processes can be a game-changer. - Online Directories & B2B Marketplaces

With the expansion of e-commerce, more B2B marketplaces now connect retailers with wholesalers specializing in specific niches—like organic treats or freeze-dried products. Searching these platforms can yield more specialized or cost-effective options.

6. Evolving Categories: Dogs, Cats, and Beyond

While dogs still dominate the pet treat market in terms of sales volume, the fastest growth segment is often in cat treats. Let’s explore some key categories:

6.1 Dog Treats

- Training Treats: Smaller, bite-sized, often low-calorie. Growing in popularity as more people adopt puppies and prioritize training.

- Dental Chews: Multi-functional products aimed at improving oral health. According to a 2023 Veterinary Oral Health Council study, over 45% of dog owners purchase dental treats regularly.

- Freeze-Dried & Dehydrated: Seen as premium offerings that lock in flavor and nutrients. These are part of the broader human-grade food trend, as pet owners desire minimal processing.

6.2 Cat Treats

- Protein-Rich Snacks: Cats are obligate carnivores, so treats high in protein—like fish or poultry—are popular.

- Texture Variety: Crunchy, semi-moist, or lickable cat treats are all vying for attention. Consumers look for options that combine taste with functional benefits (e.g., hairball control).

- Cat-Specific Functional Treats: Innovations addressing urinary tract health, hairball control, or appetite stimulation are on the rise.

6.3 Emerging Niches

- Exotic Proteins: Duck, venison, quail, or even insect-based proteins. These cater to pets with specific allergies or to eco-conscious owners seeking more sustainable protein sources.

- Holistic & Herbal Blends: Some brands incorporate herbs like chamomile, peppermint, or turmeric for added health benefits.

- Species-Specific Needs: Beyond dogs and cats, smaller segments of the market cater to reptiles, birds, or small mammals, although these remain niche.

7. E-commerce & Omnichannel Impact

7.1 Rapid Rise in Online Pet Retail

Online sales of pet treats soared in the early 2020s, and by 2025, e-commerce remains an indispensable channel. Many pet owners enjoy the convenience of auto-ship subscriptions from platforms like Chewy or Amazon. Independent online retailers also flourish by offering curated treat selections or focusing on a particular niche.

7.2 Omnichannel Strategies

Consumers increasingly expect a seamless shopping experience—whether they’re browsing in-store, ordering online for curbside pickup, or receiving home delivery. Successful pet treat retailers integrate these channels, ensuring consistent product availability and brand messaging across platforms.

7.3 B2B Online Platforms

On the business side, more wholesale pet treats transactions are occurring through specialized B2B marketplaces. By digitizing transactions, wholesalers and retailers can streamline negotiations, monitor real-time inventory, and receive data-driven insights on consumer demand.

8. Regulations, Labeling, and Quality Assurance

8.1 Federal Oversight

The Food and Drug Administration (FDA) and the Association of American Feed Control Officials (AAFCO) regulate pet treats in the US. Wholesalers must ensure their products meet labeling requirements and nutritional standards to avoid compliance issues.

8.2 Labeling Requirements

In 2025, label transparency is paramount. Pet owners not only want to know the ingredients, but also how the treat was manufactured. Many brands place additional symbols or certifications (e.g., USDA Organic, Non-GMO, or Marine Stewardship Council) on their packaging to convey quality and trust.

8.3 Quality Audits & Third-Party Certifications

Retailers often prefer to work with wholesalers that have recognized certifications—such as Safe Quality Food (SQF) or British Retail Consortium (BRC) certifications—as these indicate a commitment to rigorous quality standards. Wholesalers offering thorough documentation and testing results are better positioned to form enduring partnerships.

9. Future Outlook: Pet Treats in 2025 and Beyond

9.1 Technology & Personalization

Innovation continues to disrupt the industry. Some trends include:

- Smart Treat Dispensers: Integrated with home automation systems, allowing pet owners to feed treats remotely.

- Personalized Nutrition Plans: DNA testing and nutritional profiling could lead to hyper-personalized treats tailored to specific health needs or genetic markers.

9.2 Collaboration & Co-Branding

Retailers may partner with popular lifestyle or nutrition brands to co-develop pet treats that align with a certain ethos—be it fitness, sustainability, or gourmet culinary experiences. Co-branding not only drives sales but also helps brands tap into broader consumer bases.

9.3 Growth in Wholesale Freeze Dried Dog Treats

Among all categories, wholesale freeze dried dog treats stand out for their premium positioning and nutritional profile. As more consumers equate freeze-dried with “healthy” and “all-natural,” the demand for these products will likely intensify. Wholesalers who can offer bulk rates on freeze-dried products, while maintaining exceptional quality, will enjoy a competitive edge.

10. Conclusion

The US pet treats market in 2025 is dynamic and layered, reflecting broader social shifts in pet humanization, health-conscious spending, and sustainability. For distributors, retailers, and manufacturers, the key to thriving lies in recognizing and adapting to these changes. By focusing on quality, transparency, and innovation, businesses can align with the evolving preferences of pet owners who seek the very best for their furry companions.

Whether you’re looking for wholesale cat treats to fill shelves in a local pet store or plan to launch a new line of wholesale dog treats on your e-commerce platform, staying updated on market trends, regulatory requirements, and consumer behaviors is paramount. Partnerships with reputable wholesalers can streamline your operations, boost your profit margins, and build trust with your customer base.

For more insights into bulk purchasing and private labeling options, check out Pack’n Pride, a leading pet treats manufacturer known for quality, innovation, and reliability. Taking the time to align with partners who share your commitment to excellence is the first step toward success in this vibrant and evolving industry.

Additional Resources

- APPA – American Pet Products Association

Annual reports on pet ownership statistics, market growth, and consumer behavior. - Pet Food Industry

Regularly updated research, market data, and expert articles on pet food and treats. - FDA Pet Food Labeling Regulations

Guidelines on labeling requirements and safety standards. - AAFCO – Association of American Feed Control Officials

Regulatory framework and nutritional guidelines for pet food and treats.